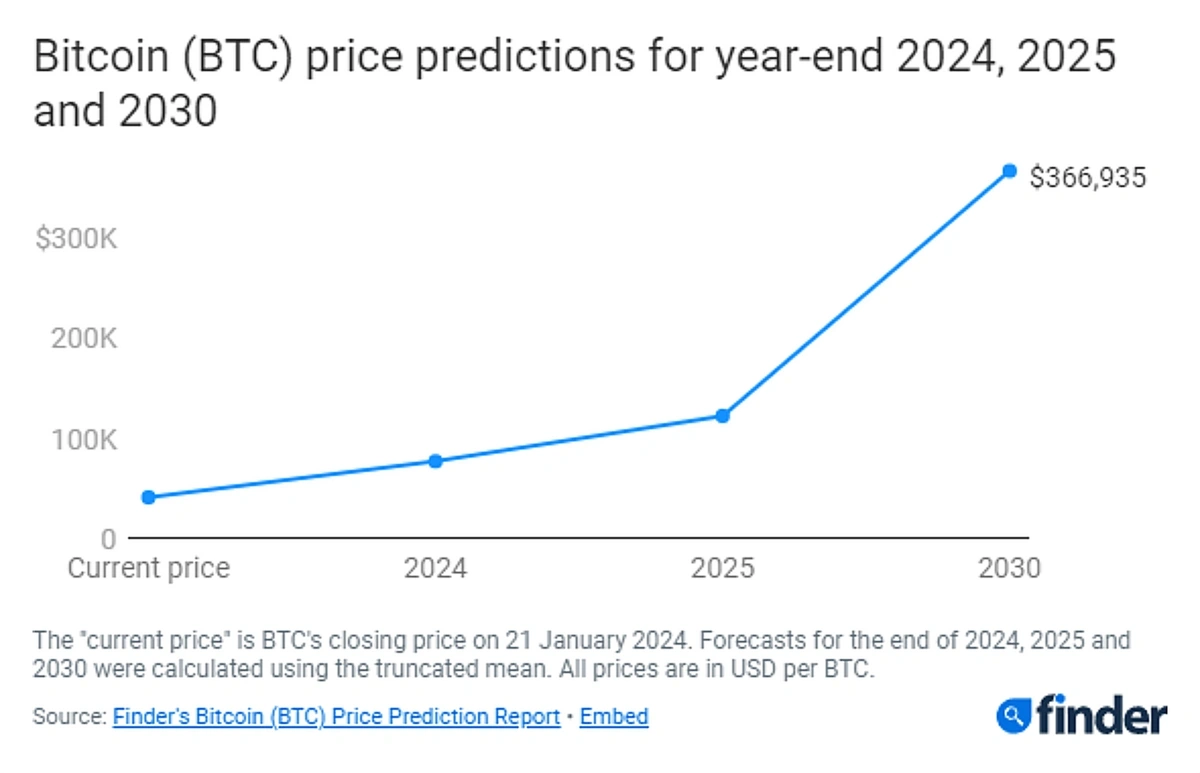

The cryptocurrency market is witnessing a significant transformation as Bitcoin's value surged by 150% entering 2024. Analysts predict this bull run could persist well into 2025, with Bitcoin starting the year at approximately $44,000 and climbing to nearly $70,000 by late May. A recent survey suggests Bitcoin could reach $77,000 by the end of 2024 and $123,000 by the end of 2025.

Survey respondents predict a significant surge in Bitcoin’s value between 2025-2030.

Key Drivers of the Bull Market

Two primary factors are fueling this bullish sentiment: the approval of spot Bitcoin ETFs and the impending Bitcoin halving event. The U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETFs in January 2024, marking a pivotal moment for the cryptocurrency market.

Spot Bitcoin ETFs allow investors to gain exposure to Bitcoin without directly holding the asset, making it more accessible to retail and institutional investors alike. Major players like BlackRock and Fidelity are leading the charge, with BlackRock managing $15 billion in Bitcoin assets and Fidelity holding $9 billion.

The Role of Bitcoin Halving

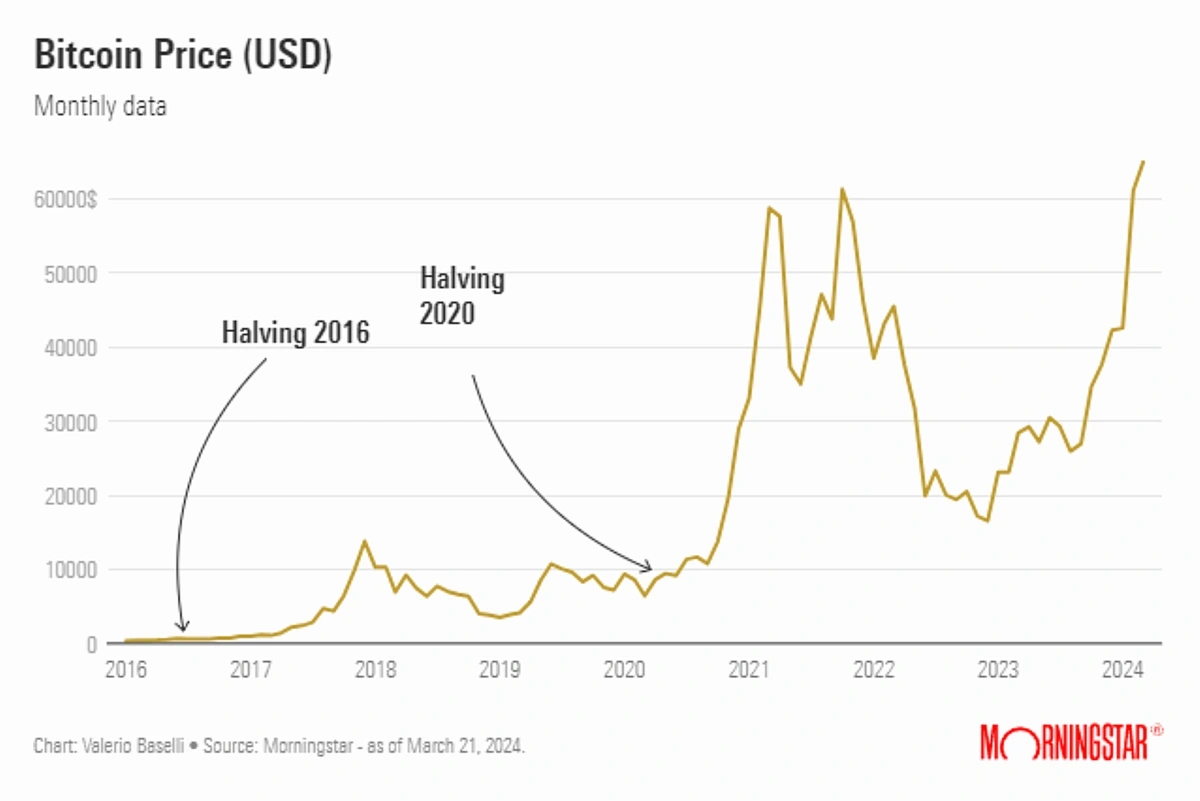

The upcoming Bitcoin halving, scheduled for April 2024, further enhances market interest. This event, which occurs approximately every four years, reduces the reward for mining Bitcoin by half, effectively decreasing the supply of new Bitcoin entering the market. Historically, such halvings have preceded substantial price increases, although the effects are not always immediate.

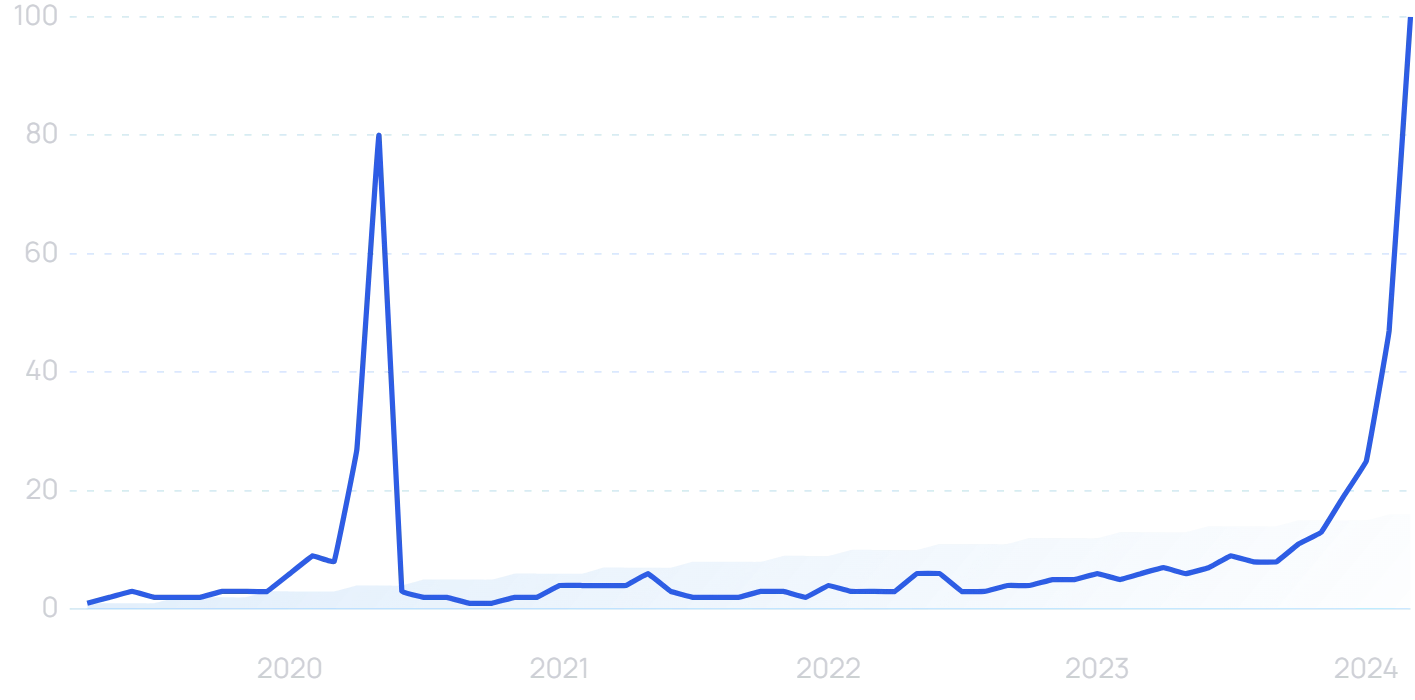

Search interest in "Bitcoin halving" has surged leading up to the next event.

Historical Trends and Predictions

Previous halvings resulted in significant price gains, with increases of 51% in 2016 and 83% in 2020 within six months following the events. Nearly half of crypto experts believe that similar gains will occur post-April 2024 halving, with many predicting Bitcoin will surpass its all-time high shortly thereafter.

The previous two halving events positively impacted the value of Bitcoin.

Conclusion

The convergence of ETF approvals and the upcoming halving event positions Bitcoin for a potentially historic bull run. As institutional interest grows and retail investors gain easier access to Bitcoin through ETFs, the market is set for exciting developments in the coming months. With predictions for Bitcoin's price reaching new heights, investors are keenly watching these trends unfold.